tax identity theft def

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. IRS Form 14039 is an identity theft affidavit that you send the IRS if your personal information has been stolen.

Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make.

. Place a fraud alert on your credit file with one of the three major. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR or.

Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. More from HR Block. Due to federally declared disaster in 2017 andor 2018 the.

If youre an actual or potential victim of identity theft and would like the IRS to mark your account to identify any questionable activity please complete Form 14039 Identity. Bookkeeping Let a professional handle your small business books. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Learn what the IRS identity theft indicator means. After the IRS processes your identity theft affidavit the IRS will place an identity.

They can also use your Social Security Number SSN to get a job and report the. Small business tax prep File yourself or with a small business certified tax professional. Employment-related tax identity theft occurs when someone uses your Social Security Number SSN to get a job and then reports the income under your SSN.

What To Do If You Are A Victim. The most common method is to use a persons authentic name address and Social Security Numberto file a tax return with. Identity thieves can use your personal information to file a fraudulent tax return and steal your tax refund.

Read the IRS definition and get more insight from the experts at HR Block. One of the major identity theft categories is tax identity theft. If you suspect you are a victim of tax identity theft here are some steps to follow.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. More from HR Block. File taxes online Simple steps easy tools.

IRS Definition In situations where a taxpayer makes an allegation of identity theft or when the IRS initially suspects that identity theft may have occurred IRS functions will apply an identity theft. Due to federally declared disaster in 2017 andor 2018 the. People often discover tax identity theft when they file their tax returns.

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return. H and R block Skip. Youd normally find out about.

:max_bytes(150000):strip_icc()/GettyImages-615850898-b990d957c45d438496992809318b0584.jpg)

What Is Identity Theft Definition Laws And Prevention

Attention Identity Theft Definition Ppt Download

Identity Theft Irs Needs To Better Assess The Risks Of Refund Fraud On Business Related Returns U S Gao

Employment Related Identity Fraud Improved Collaboration And Other Actions Would Help Irs And Ssa Address Risks U S Gao

Child Identity Theft How It Happens What To Do About It Aura

What Is Identity Theft Malwarebytes

Identity Theft Laws In California Penal Code 530 5 Pc

Posts By Admin Christian Credit Counselors Page 8

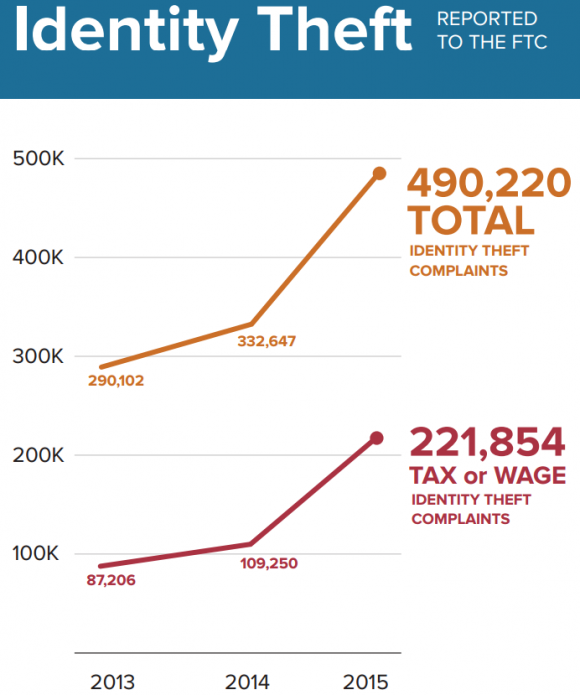

Ftc Tax Fraud Behind 47 Spike In Id Theft Krebs On Security

Aggravated Identity Theft Easter Devore Attorneys At Law Knoxville

![]()

Business Identity Theft National Cybersecurity Society

Tax Identity Theft Awareness Consumer Advice

Identity Theft Irs Needs To Better Assess The Risks Of Refund Fraud On Business Related Returns U S Gao

What Happens After You Report Tax Identity Theft To The Irs H R Block

Identity Theft Definition What Is Identity Theft Avg

What The Irs Isn T Telling You About Identity Theft

Guide To Irs Form 14039 Identity Theft Affidavit Turbotax Tax Tips Videos